Share this Post

Numbers to Keep in Mind for 2026

Every year, key figures like retirement contribution limits, tax brackets, and other financial thresholds are updated. Keeping up with these changes isn’t just good housekeeping—it can help you avoid surprises and make the most of your planning opportunities.

As we head into 2026, several important limits and brackets have shifted to reflect inflation. Here’s a quick look at what’s new, and what these changes could mean for your financial strategy.

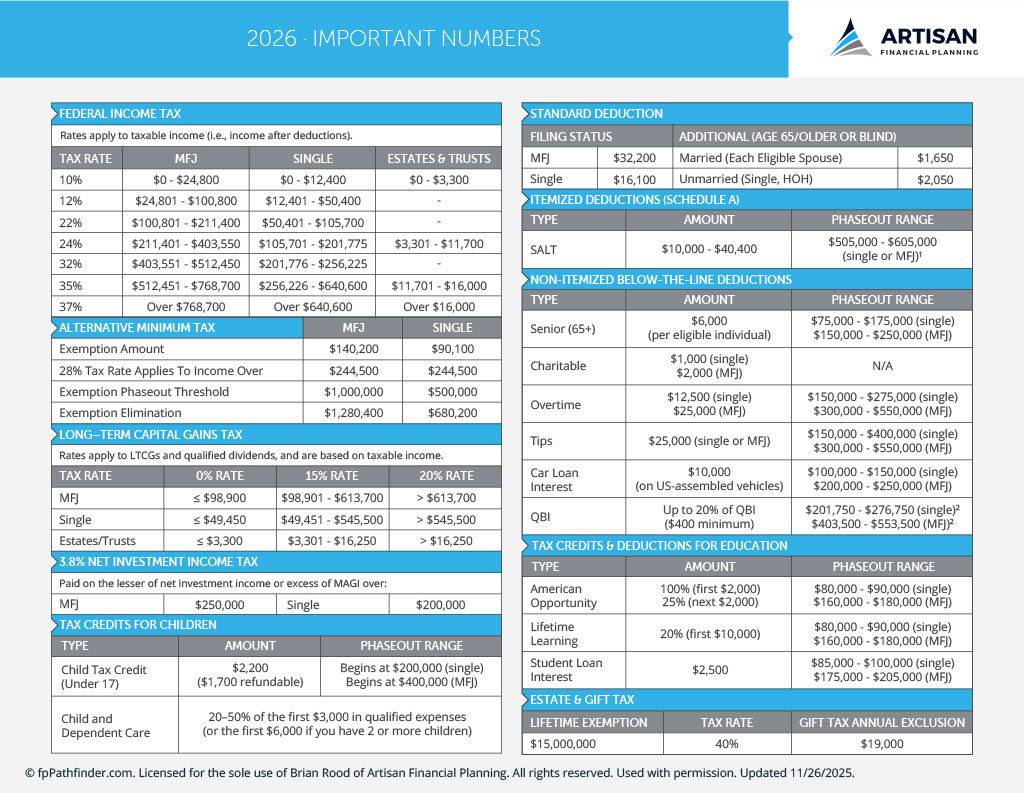

Federal Income Tax Brackets

Brackets for individuals start at 10% for incomes up to $12,400 and climb to 37% for incomes over $640,600. For married couples filing jointly, the 10% bracket covers incomes up to $24,800 and climbs to 37% for incomes over $768,700.

There are 12%, 22%, 24%, 32% and 35% brackets in between.

Standard Deduction

The standard deduction has increased to $32,200 for married couples filing jointly and $16,100 for single filers.

Long-Term Capital Gains Tax

Capital gains tax rates are based on taxable income, with 0% rate applying to incomes up to $98,900 for married couples and $49,450 for singles. The 15% rate ranges from $98,901 to $613,700 for married couples and $48,350 to $533,400 for single filers. The 20% rate applies for incomes higher than these levels.

Retirement Plan Limits

The contribution limit for 401(k) and 403(b) plans is now $23,500 with a catch-up contribution up to $7,500 for individuals aged 50 and above. Certain 403(b) plans provide for additional special catch-up contributions.

IRA and Roth IRA Contributions

IRA and Roth IRA contributions for 2026 have been raised to $7,500 for those under age 50, with a catch-up contribution up to $1,000 for those age 50+.

The phaseout ranges for traditional IRA deductibility (if covered by a workplace retirement plan) start at $81,000 and end at $91,000 for single filers and $129,000 to $149,000 for Married Filing Jointly.

For Roth IRA, the phaseout ranges from $242,000 to $252,000 for married couples filing jointly and $153,000 - $168,000 for single filers.

Health Savings Account (HSA)

HSAs continue to be one of the most tax-efficient savings vehicles available, and contribution limits have increased for 2026. The HSA contribution limits are $4,400 for individuals and $8,750 for families. The age 55 and over catch-up contribution limit remains at $1,000 for 2026.

Social Security Updates

The Social Security wage base for 2026 is set at $184,500, with a Cost Of Living Adjustment (COLA) of 2.8% and provides a modest increase for those receiving Social Security.

Estate & Gift Tax

The lifetime exemption for estate and gift tax is $15 million per individual in 2026. The annual gift tax exclusion has been increased to $19,000.

This means you can give up to $19,000 to as many individuals as you like without triggering gift tax reporting requirements.

These revised numbers can greatly affect your retirement planning, investment decisions and tax strategies. Please feel free to reach out to me for more information or personalized advice.

You can download a more in-depth PDF below that details these changes (click on the image to download the full PDF).