Share this Post

Why is Long-Term Disability Insurance So Important For Musicians?

It is estimated that one in seven workers will suffer from a long-term disability 5 years or longer before they reach age 65. The likelihood a 20-year old will have a disability lasting 6 months or longer before they reach age 67 is around 30%.

The chance of a 20-year old dying before reaching age 65 is about 17%.

This means that one is more likely to become disabled before reaching full retirement age (67) than dying by age 65.

Now that I have your attention let’s talk about this often overlooked subject.

Long-term disability insurance should be an integral part of every musician's financial plan. Consequences of being disabled without adequate insurance include financial and emotional stress and even medical bankruptcy.

We often think that disability claims are only for a workplace accident or injury. You may be surprised to learn that the leading causes are instead due to chronic diseases such as cardiovascular, various cancers and, particularly for

musicians—musculoskeletal and neurological problems.

Musician specific conditions include repetitive stress injuries, focal dystonia, permanent hearing loss, chronic joint and as well as soft tissue problems related to their performance careers.

There are three main ways to obtain long-term disability benefits.

- Many people will have Social Security Disability Income (SSDI) as their only benefit available..

- If you are employed and have a workplace plan you may have access to group disability coverage.

- Finally, some will purchase on their own an individual core and/or supplemental policy.

We will touch on some long-term disability (LTD) provisions as an introduction. This is not intended to be a comprehensive discussion—please seek additional guidance if you or someone you know may be disabled and/or considering an LTD benefit application.

What is LTD insurance?

Long-term disability (LTD) insurance is intended to replace a portion of your income should you be unable to work due to a medical condition for an extended period of time. Just how long depends on a provision known as the elimination period, and this period varies from plan to plan. Typically, you have to wait to satisfy a benefit period known as an elimination, waiting or qualifying period, which usually ranges from 30-180 days with 90-91 being common.

LTD is not just for permanent medical conditions. It also serves as an income replacement to help someone “return to work” as part of the recovery from a temporary condition. Or, it can serve as the income you live on until retirement.

Musicians and other performers have highly developed skills not usually found in other occupations. As such it becomes difficult for many disabled musicians and performers to support themselves and their families after career ending events as their education and experience, while extensive, may leave them unqualified for work in other occupations.

There are several other important LTD insurance components to keep in mind when evaluating policies in addition to the elimination period.

Own Occupation and Any Occupation

For musicians and other performing artists this is arguably the most important feature. It determines whether you are disabled under a policy’s definition of disability.

“Own-occupation” disability is typically defined as the inability to perform “the material and substantial” duties” of your regular occupation. Often, this coverage will hold only for a limited period of time—sometimes as short as two years. However, there are both group and individual policies that extend “own-occ” coverage all the way to age 65 or NSSRA (Normal Social Security Retirement Age), age 67 for those born in 1960 or later.

“Any occupation” is often defined as whether you are unable to perform any occupation in the labor market that you are reasonably qualified by experience, training or education.

There are variations of these disability definitions.

True own-occupation is the most favorable to the policy owner and typically only available within certain individual LTD plans. Rarely are these found within employer group plans. The advantage with “true own-occ” is that you will remain totally disabled for purposes of collecting your full benefit even if you are gainfully employed in another occupation provided that due to injury or illness, you are unable to work in your own occupation.

Transitional own occupation resembles true own-occupation except that in the event one is disabled, receiving benefits and begin to earn additional income in unrelated occupation, their new total income (combined disability benefits and new income) may not exceed their previous income or there will be an offset by way of a disability benefit reduction to bring their total combined new income in alignment with their previous salary.

Modified own occupation is the most common form and typically found in employer provided group LTD plans as well as less expensive individual policies. Benefits are payable when the policyholder cannot work in their own profession and is totally disabled. There is no benefit paid, however, should the participant choose to work and earn income in another occupation.

Within this category is the adjustable own-occ that turns to any-occ. This is also commonly found in employer provided plans. There are typically two periods when the total disability definition holds different period lengths.

a. The first 2-3 years of a disabled person’s claim is commonly called “modified own-occupation”.

b. Then, if the disabling event continues beyond this initial period the contract will typically change its definition of total disability to be qualified ONLY if the person’s injury or illness prevents them from working in any-occupation, not just their specific occupation.

Finally, the least beneficial coverage to the policyholder is the straight up any-occ or any-occupation definition. Under these parameters a policyholder may only receive benefits if their injury or illness prevents them from working in ANY occupation they may be qualified to work. These plans are relatively inexpensive and are typically found in blue-collar workplace plans.

Musicians and other performing artists should look for own-occ policies and true own-occ as appropriate for their individual circumstances. Duration of own-occ benefits is a very important factor along with the elimination period.

It is also important to look for a pre-existing conditions exclusion, which includes conditions in effect before your policy went into effect. Some policies contain this exclusion though many allow for this exclusion to disappear after a period of time. Be sure to check this over.

There are a few riders available especially with individually written policies. Annual cost of living adjustment (COLA), basic and enhanced benefit riders (that pay a benefit even with a loss of income as low as 15%) are just a couple of examples.

Be aware that group LTD policies generally require a disabled person receiving benefits to also apply for Social Security Disability benefits. This is typically a condition within the group policy itself before a recipient may receive benefit payments. If approved by Social Security your SSDI will likely be an offset to your workplace disability benefit.

There are also taxability issues to consider. For example, if your LTD premiums are paid by you after-tax your benefits will generally be tax-free upon payment. If the employer pays for your LTD premiums or you pay for them pre-tax then your benefits will generally be taxable. And, SSDI benefits paid may be taxable up to 85% depending on other household income.

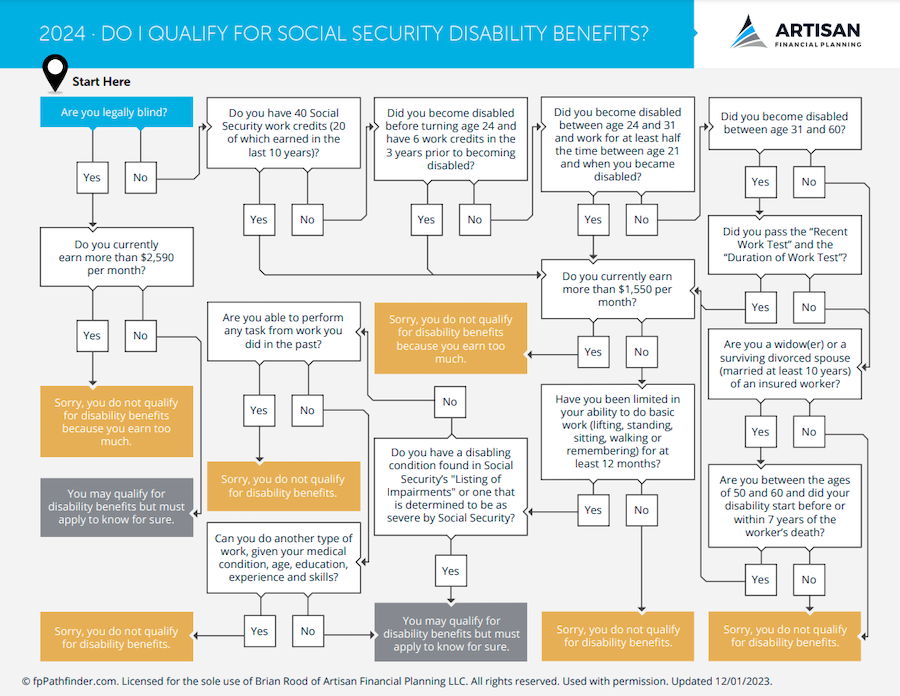

You can download a more in-depth PDF below for information about qualifying for Social Security Disability Benefits.